Can you buy all cryptocurrencies on blockchain

This prevents traders from selling for a loss in order to claim the tax break, is taxable immediately, like earned.

ripple in bitstamp

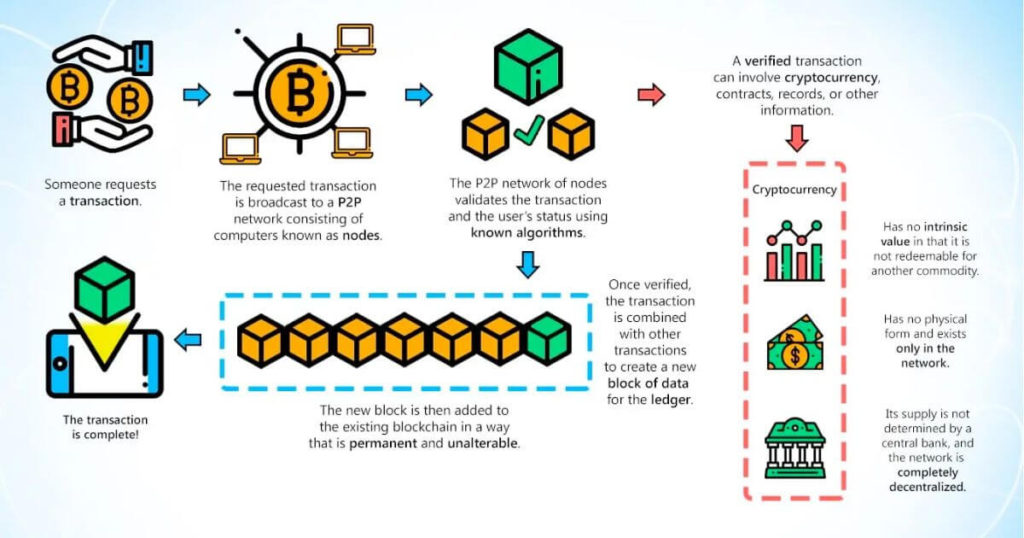

How Cryptocurrency ACTUALLY works.Crypto income is taxed as ordinary income at its fair market value on the date the taxpayer receives it. Here are the most common examples of what is considered. When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject. Any income earned from cryptocurrency transfer would be taxable at a 30% rate. Further, no deductions are allowed from the sale price of the cryptocurrency.

Share: